To change your HMRC address, you need to update it through the HMRC Online Services account or by contacting HMRC directly. Changing your address is a simple process that can be done through digital platforms or by reaching out to HMRC.

Intro: Changing your address with HM Revenue and Customs (HMRC) is a straightforward process that can be done through their online services or by contacting them directly. Whether you have recently moved or need to update your address for any other reason, it is important to keep HMRC informed to ensure you receive any important correspondence, documents, or notifications.

We will guide you through the steps to change your HMRC address, providing all the necessary information to make the process quick and hassle-free. Stay tuned to learn how you can easily update your address and prevent any potential issues with HMRC communications.

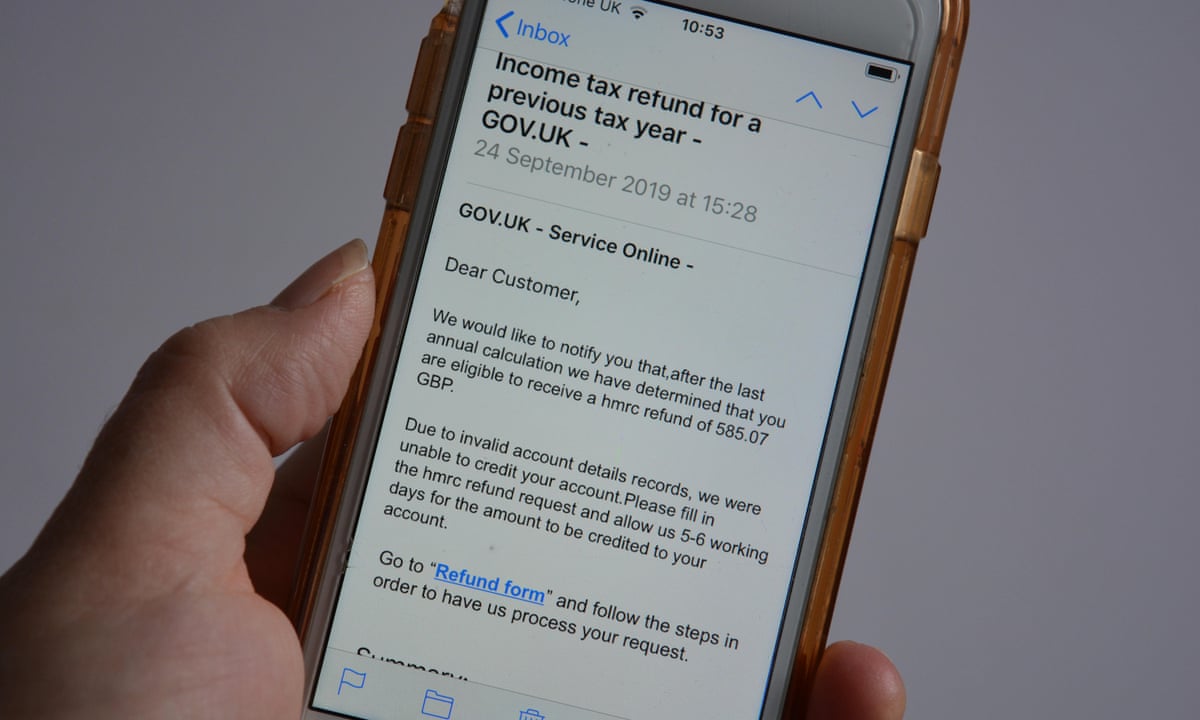

Credit: www.theguardian.com

Methods For Changing Your Hmrc Address

Learn how to change your HMRC address with these simple methods. Follow the guidelines provided to ensure a smooth transition and avoid any potential issues with your taxes.

Changing your HMRC (Her Majesty’s Revenue and Customs) address is a simple process that can be done through different methods. Whether you prefer the convenience of the online method, the ease of a telephone call, or the traditional postal mail option, you have the flexibility to choose. Below, we will outline each method in detail, ensuring you have all the information you need to successfully update your HMRC address.Online Method

To change your HMRC address online, follow these steps:- Visit the HMRC website and log in to your account

- Navigate to the ‘Change of Address’ section

- Provide the required information, including your new address details

- Double-check the accuracy of the information you have entered

- Submit the form

By Telephone

Changing your HMRC address over the phone is another convenient option. Simply follow these steps:- Locate the HMRC contact number specific to your needs

- Call the appropriate number and wait to be connected to a representative

- Inform the representative that you wish to change your address

- Provide the necessary information, such as your name, National Insurance number, and current and new address details

- Listen carefully to the instructions provided by the representative and ensure the information is accurate

Through Postal Mail

If you prefer the more traditional route, you can change your HMRC address through postal mail. Here’s how:- Obtain a Change of Address form from the HMRC website or your local post office

- Fill out the form with your updated address information

- Include any necessary supporting documents, such as proof of address, as instructed

- Double-check the accuracy of the information provided

- Mail the form and supporting documents to the designated HMRC address

Credit: www.facebook.com

Important Considerations And Tips

Change your HMRC address smoothly with these important considerations and helpful tips. Follow these guidelines for a seamless process and ensure your information is up-to-date. Don’t forget to update other relevant agencies and inform your employers or pension providers about the address change.

Introduction: Important Considerations And Tips

In order to ensure a smooth and successful change of address with HMRC (Her Majesty’s Revenue and Customs), there are several important considerations and tips to keep in mind. Making sure you are well-prepared, providing accurate information, and notifying other relevant organizations are key steps in this process. Follow the helpful guidelines below to navigate changing your HMRC address seamlessly.

Preparing The Required Documentation

Before initiating the change of address process with HMRC, it is crucial to gather and prepare the necessary documentation to avoid any delays or complications. Keeping your documents organized and readily available will expedite the process and ensure a hassle-free experience. Prepare the following documents:

- Proof of your new address, such as a utility bill or tenancy agreement, to verify your updated residential details.

- Your National Insurance number or Unique Taxpayer Reference (UTR) number, which will help HMRC locate your records quickly.

- Details of any changes to your employment or business situation, if applicable, to provide accurate information regarding your income.

- Bank account details for direct debit or payment purposes, as HMRC may need to update their records accordingly.

Providing Accurate Information

When completing the address change process with HMRC, it is essential to provide accurate and up-to-date information. This ensures that HMRC has the correct details on file and can effectively communicate with you regarding any tax-related matters. Follow these tips to ensure accuracy:

- Double-check all the information you provide, including your new address, contact details, and any changes to your employment or business situation.

- Ensure that the documentation you submit as proof of your new address is recent, valid, and clearly shows your name and the new address.

- If you are unsure about any details or need clarification, it is advisable to contact HMRC directly through their helpline or online support.

- Keep a record of the date and time you submitted the change of address request, as well as any reference or confirmation numbers provided by HMRC.

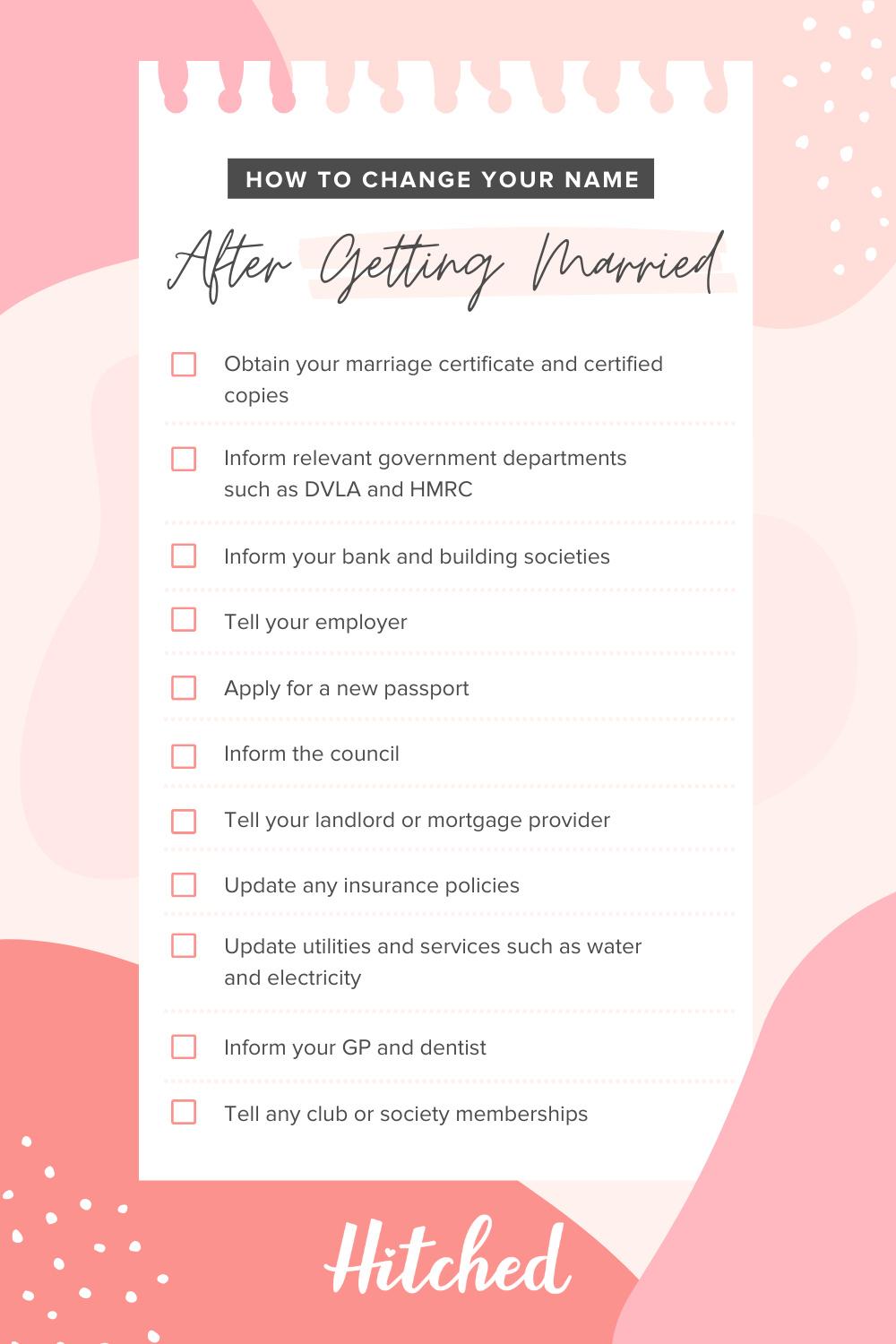

Notifying Other Organizations

Changing your address with HMRC is a vital step, but it is equally important to inform other relevant organizations to ensure a smooth transition. Here are some organizations you may need to notify:

| Organization | Contact Information |

|---|---|

| Employer or pension provider | Notify your employer or pension provider of your new address to ensure accurate payroll or pension information. |

| Electoral Register | Update your address on the electoral register to exercise your voting rights at your new location. |

| Department for Work and Pensions (DWP) | Inform the DWP if you receive any benefits or have ongoing claims to prevent disruptions in payments. |

| Local Council | Notify your local council to update your details for any council tax or other local government-related matters. |

By notifying these organizations promptly, you can ensure that your address change is properly reflected in all relevant records, preventing any potential complications or missed correspondence.

Credit: www.theguardian.com

Frequently Asked Questions On How To Change Hmrc Address

How To Change Hmrc Address Online?

To change your HMRC address online, log in to your account, go to the “Personal details” section, and click on “Change address. ” Follow the instructions, provide the new address details, and submit the changes. Make sure to update your address for all relevant taxes and benefits.

Can I Change My Hmrc Address By Phone?

Yes, you can change your HMRC address by phone. Simply call the appropriate HMRC helpline for your specific tax obligations and inform them about your address change. Have your personal details and necessary documents ready to complete the address update process efficiently.

Is It Necessary To Inform Hmrc If I Move House?

Yes, it is necessary to inform HMRC if you move house. Keeping your address updated with HMRC ensures that you receive important communications and updates about your taxes, benefits, and other obligations. Failing to inform HMRC about your address change may result in missed deadlines or incorrect information being sent to your old address.

Conclusion

Changing your HMRC address doesn’t have to be overwhelming. By following the simple steps outlined in this blog post, you can easily update your address and ensure that your tax and financial matters are properly managed. Remember to notify HMRC promptly to avoid any potential issues or delays.

With this information at hand, you can confidently tackle the process and stay on top of your tax responsibilities.