To change TSP contribution, visit the TSP website or call the TSP service office. Changing your TSP contribution is a simple process that can be done online or by phone.

By adjusting your contribution, you can take control of your retirement savings and ensure that you are saving the right amount for your needs. Whether you want to increase or decrease your contribution, you have the flexibility to make changes whenever you need to.

We will guide you through the steps to change your TSP contribution, making the process quick and hassle-free. So, let’s get started and take control of your financial future.

Credit: www.mycg.uscg.mil

Understanding The Tsp Contribution

Do you want to take control of your retirement savings? Understanding the Thrift Savings Plan (TSP) contribution is the first step towards securing your financial future. In this article, we will delve into the basics of the TSP and how its contribution system works.

What Is The Tsp?

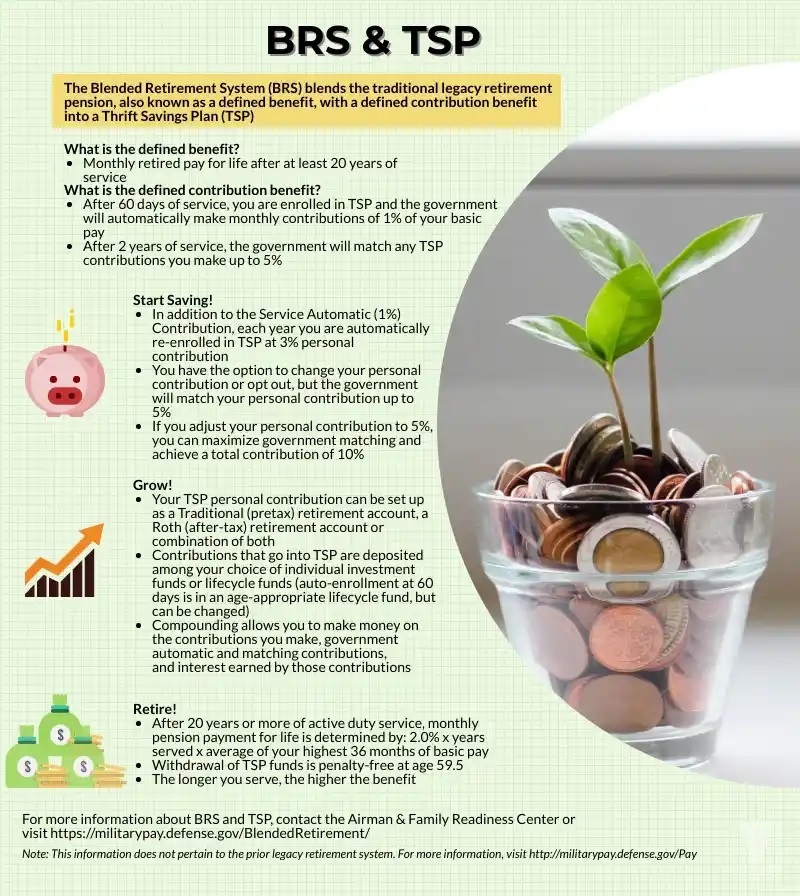

The Thrift Savings Plan, or TSP, is a retirement savings vehicle available to federal employees, serving as the government’s version of a 401(k) plan. It allows you to invest a portion of your income towards a comfortable retirement. The TSP offers various investment options to suit your risk tolerance and financial goals.

How Does The Tsp Contribution Work?

The TSP contribution system empowers you to control the percentage of your salary set aside for retirement savings. You can choose from three contribution types:

- Traditional TSP Contribution: This contribution type allows you to defer taxes on the amount you contribute, reducing your taxable income in the present. However, you will have to pay taxes on your withdrawals during retirement.

- Roth TSP Contribution: With a Roth TSP, you contribute after-tax dollars, meaning your contributions are not tax-deductible. However, qualified withdrawals in retirement are tax-free, including any earnings on your investments.

- Combined Traditional and Roth Contributions: If you’re unsure which contribution type suits you best, the TSP allows you to contribute to both the traditional and Roth accounts simultaneously, giving you flexibility and potential tax advantages.

Determining how much to contribute is a crucial decision. Consider factors like your budget, income, and retirement goals. A good starting point is to contribute at least the amount that your agency matches, often referred to as the “free money” portion.

When it comes to changing your TSP contribution, the process is relatively simple. You can update your contribution percentage through your TSP account online or by completing the Federal Retirement Thrift Investment Board (FRTIB) Form TSP-1.

Determining Your Ideal Tsp Contribution

Determining your ideal TSP contribution is a crucial step in managing your retirement savings. This article will guide you on how to change your TSP contribution and make the most out of your investment strategy.

Assess Your Financial Goals

Determining the ideal contribution to your Thrift Savings Plan (TSP) requires careful consideration of your financial goals. Begin by assessing what you hope to achieve in both the short and long term. Are you saving for retirement? Want to buy a house or pay off debts? By identifying your specific goals, you can better determine the amount you need to contribute to your TSP.

Consider Your Risk Tolerance

Another factor to consider when determining your TSP contribution is your risk tolerance. Evaluating how comfortable you are with the ups and downs of the market will help guide your decision. Are you willing to take on more risk in pursuit of potentially higher returns, or do you prefer a more conservative approach? Understanding your risk tolerance will influence the percentage of your income you allocate to the TSP.

Evaluate Your Current Contribution Level

It’s crucial to regularly evaluate your current TSP contribution level to ensure it aligns with your financial goals and risk tolerance. This assessment will help you determine if adjustments are necessary. If you’re contributing too little, you may not be maximizing the benefits offered by the TSP. Conversely, contributing too much might strain your current financial situation. Evaluating your current contribution level will help ensure you strike the right balance.

Steps For Changing Your Tsp Contribution

Changing your TSP contribution is a simple process that can help you take control of your retirement savings. By adjusting your contribution amount, you can ensure you’re saving enough to meet your goals. Whether you want to increase, decrease, or make any changes to your TSP contribution, the following steps will guide you through the process.

Review The Contribution Limits

Before making any changes, it’s important to understand the contribution limits set by the TSP. These limits dictate how much you can contribute to your TSP account each year. The current limit for regular contributions is $19,500. Additionally, if you are 50 years or older, you may be eligible for catch-up contributions of up to $6,500 on top of the regular limit.

Access Your Online Tsp Account

To begin the process of changing your TSP contribution, you need to access your online account. Simply log in to the TSP website using your username and password. If you haven’t registered for an online account yet, you can easily do so by following the registration instructions on the website.

Modify Your Contribution Amount

Once you’ve logged in to your online TSP account, navigate to the contribution section. Here, you will find options to modify your contribution amount. You can increase, decrease, or stop your contributions altogether. Keep in mind that any changes you make will be effective from the beginning of the next pay period.

If you’re increasing your contribution, it’s a good idea to set a reminder to review and potentially adjust your contribution amount annually. This way, you can ensure that your contributions align with your financial goals and any changes in the contribution limits.

Consider Catch-up Contributions

If you are 50 years or older, you have the opportunity to make catch-up contributions to boost your retirement savings. These catch-up contributions can help you bridge the gap if you haven’t been able to save as much as you would have liked in previous years.

To make catch-up contributions, you can select the appropriate option in the contribution section of your online TSP account. Remember to review the catch-up contribution limits to ensure you stay within the allowable amount.

By following these steps, you can easily make changes to your TSP contribution and take charge of your retirement savings. Remember to review the contribution limits, access your online TSP account, modify your contribution amount, and consider catch-up contributions to maximize your savings potential.

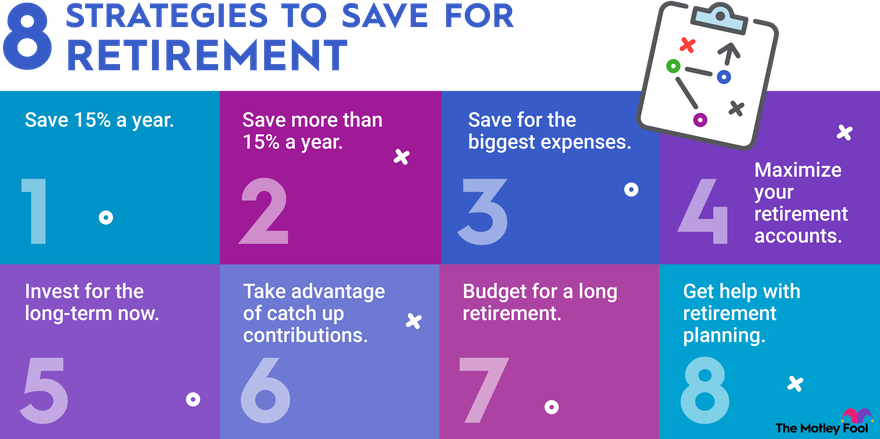

Credit: www.fool.com

Credit: www.horizontrust.com

Frequently Asked Questions For How To Change Tsp Contribution

Can I Change My Tsp Contribution At Any Time?

Yes, you can change your TSP contribution at any time using the TSP website or by completing form TSP-1. Keep in mind that your changes will take effect the pay period after the TSP receives your request.

How Often Can I Change My Tsp Contribution?

You can change your TSP contribution as often as once per pay period. However, keep in mind that any changes you make will take effect the pay period after the TSP receives your request.

What Happens If I Don’t Change My Tsp Contribution?

If you don’t change your TSP contribution, it will remain the same as your previous contribution amount. Keep in mind that if you’re not contributing at least enough to get the maximum match from your employer, you may be missing out on free money.

How Do I Increase My Tsp Contribution?

To increase your TSP contribution, log in to the TSP website or complete Form TSP-1 and submit it to your agency. You can choose a specific percentage or dollar amount to increase your contribution by.

Conclusion

Changing your TSP contribution is a simple yet important step to take in managing your finances. By following the steps outlined in this blog post, you can confidently adjust your contribution to align with your financial goals. Remember to regularly review and reassess your contribution to ensure it continues to meet your needs.

Take control of your future and make informed decisions about your TSP contribution today.